An Inconvenient Reality

The Documentary Jumps Out Of The Screen

Welcome to the 17th edition of Honey Drops, and welcome back to work for some of you. I have noticed the tone of my conversations over the past couple of weeks to be optimistic with well-rested people, and I hope you’re in this camp as well.

We’ve got lots to do this year, so bottle the feeling and lets get cracking.

Feel free to forward this on to anyone you think would benefit from a drop on their toast, a stir in their tea or a jump start to their year.

1. L.A. Fires

This was taken in L.A. last February, on a hike near the Griffith Observatory and Hollywood sign. It was a rare sunny day in a month that would become the fourth wettest February since 1877, receiving four times the average monthly rainfall. The smog had been washed away, the greenery was lush and the hills were full of people enjoying a break in the rain.

After a dry Summer, this year’s wet season never came. That greenery turned brown. And the tinderbox awaited a spark.

The home of Hollywood is the only city that could give us this front-row view to such an unprecedented disaster. Never before have we seen such a well-known city burn like this, nor with the celebrity focal point of lost homes in the Palisades, one of the most storied neighbourhoods in the U.S.

Climate change is often intangible, until it’s not. Increasing emissions can’t be seen. Water and Waste management policies can’t be observed. Billy Crystal losing the home he has lived in since 1979 - that’s tangible. And for the first time I can remember, there are now many known faces tied to the impact of a climate tragedy, making it real, consequential and historic.

And yet, if you listen to Liz Weil in the below clip, the climate and fire experts she interviews have known this would happen, “which makes it all the more horrifying to see the same movie, again, and worse given that it is hotter and drier, it has barely rained in L.A. in seven months and there’s not a lot you can do when there is a windstorm and a fire burning”.

Worth watching:

There have been some great pieces written on the L.A. Fires in the past 10 days. If you’re looking for some extra reading: We’re In A New Era, John Valliant, Maps & Images.

One of the areas that hasn’t received much attention so far, however, is the commercial implications of this disaster as its impact ripples through the wider economy. Supply chains busted, employment opportunities non-existent, a housing shortage amplified, insurance premiums multiplying. The “cost of doing business” formulas rapidly evolving for both local businesses and national firms.

There are some larger companies who would have climate scenario analysis in place to understand their exposure and response if such an event was ever to occur to their operations, however I would hazard them to be a small minority. Scenario analysis is part of the new Australian Sustainability Reporting Standards requirements, and L.A. has shown that any pretence they are merely a box-ticking exercise is misguided at best, and a dangerous fantasy at worst.

In Australia, we know what it’s like to have floods, we know what it’s like to have droughts, we know what it’s like to have bushfires. The current conditions in L.A aren’t too dissimilar to ones experienced in Sydney, Melbourne, Adelaide or Perth, key economic hubs for employment, businesses, industries, and the national economy.

If you’re facing stakeholders asking what’s the minimum to be compliant, a deep understanding of what must be done to ensure the continuation of your organisation’s revenue generation should be pretty appealing to them.

2. 2025 Top Risks - Ian Bremmer, Eurasia Group

One of my favourite geopolitical thinkers in Ian Bremmer, who founded the Eurasia Group in 1998: “The first firm devoted exclusively to helping investors and business decision-makers understand the impact of politics on the risks and opportunities in foreign markets”.

Each year, the Eurasia Group releases their Top Risks. Their 2025 report's key takeaway is the world is returning to ‘the law of jungle’, the global powers are turning inwards to deal with their own problems, just as the traditional international agencies are losing their agency. It’s an interesting read, the definition of ‘interesting’ dependant upon your stomach for predictions.

For our Sustainability & Climate space specifically, though, there’s still good news:

“The return of Donald Trump has raised anxieties in sustainability circles that the global energy transition will be thrown into reverse this year, fed by campaign promises to “drill, baby, drill” and end the “green new scam.” Other climate-skeptic candidates outside the US— for example, in Germany, Canada, and Australia—are also likely to win elections in 2025, as global decarbonization metrics still lag scientific net-zero pathways.

“But the global energy transition survived the first Trump administration, and it will survive the second, too. The difference is that while in 2017 the global energy transition was just leaving the station, heading into 2025 it has reached escape velocity.

“This momentum is driven by economic self-interest. ”

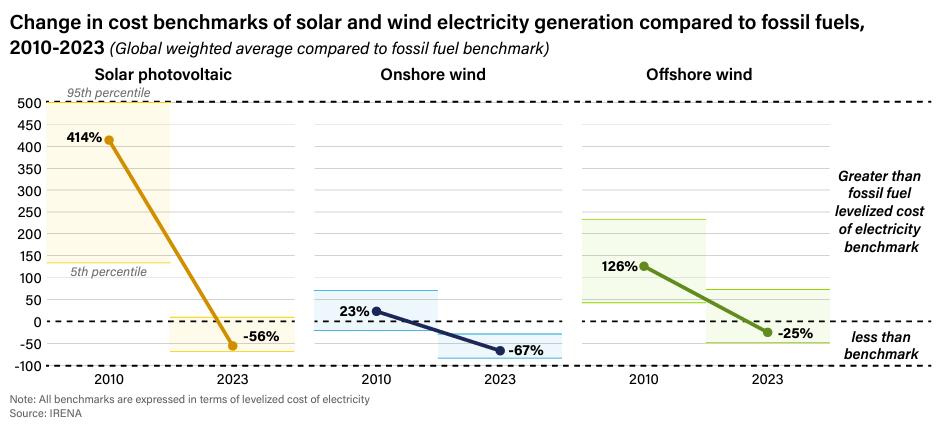

They point to the below chart as evidence of this commercial acceleration, echoing Christiana Figueres’ point from last week’s edition: the Real Economy has overtaken Geopolitics in determining the journey to net zero:

As we were reminded by countries’ elections in 2024, ‘It’s the economy, stupid’. The global shift to renewables-first economic drivers (reduced cost of goods, increased jobs, lower insurance premiums, greater investment opportunities) will result in a new definition of ‘fossil’, as the majority of companies begin evaluating their exposure to the net-negative commercial impacts of fossil fuels.

3. SBTi: Former EY Partner Named CEO

David Kennedy has been named as the new CEO of the Science-Based Target initiative, entrusted with building on the many successes the organisation has achieved to date while navigating the carbon credits debate from last year.

He’s spent his career working within climate and sustainability for both the UK Government and from within the private sector, including as the founding executive for the U.K.’s Committee on Climate Change tasked with designing the roadmap for industries’ net zero transition.

The U.K. has been a net-zero leader, and I’m optimistic this appointment will strengthen SBTi’s standing even further during this inflection point across the global economy.

2 Quotes From Others:

Turning the Investment Screws On The Wellheads - ACCR vs Shell

“Investors have cause to seek enhanced transparency from the company about its LNG Outlook because:

Shell is building its strategy around an anticipated level of demand which is higher than all scenarios put out by the International Energy Agency (IEA) and appears to have misinterpreted independent analysis in substantiating its demand projections.

Shell’s LNG demand outlook has not been materially revised in response to major changes in the global energy market.

Shell has more uncontracted LNG than any other independent oil and gas company, making it highly exposed to value erosion should prices be lower than planned for.”

Source: Shareholder Resolution to Shell plc on LNG Outlook Disclosures - ACCR

The Purveyors Of The Free Market Strike Again:

“A Coalition government would lean on banks to lend to creditworthy businesses in fossil fuels, forestry and agriculture after Opposition Leader Peter Dutton attacked “woke” bankers for rejecting loans on environmental grounds.”

Source: Banks would face new loan regime under Coalition amid ESG pushback - AFR

1 Thing For You To Ponder:

Did you know that in the second quarter of 2024, greenhouse gas emissions were estimated to have decreased in 19 EU countries when compared with the same quarter of 2023? As a leader in the post-carbon transition, this is a strong signal of success for regions around the world who are starting from further back (like Australia).

Or that a major new study in Nature has found plants are absorbing 30% more CO2 worldwide than previously thought, boosting the impact of natural sequestration and potentially tying commercial Climate and Nature initiatives even closer together.

I’m always excited to see how regularly these new developments appear to show we’re heading on the right path, that positive action leads to positive impacts and that economic factors are laying the groundwork for positive tipping points to take place.

I’ll speak more about tipping points next week, as I always love an opportunity to bring Malcolm Gladwell into the conversation. I’ll also speak about his climate equivalent, Tim Lenton, and his work. Thanks to Mark for pointing me in his direction, as well as for the suggestion of today’s headline.

Until next week,

Dan